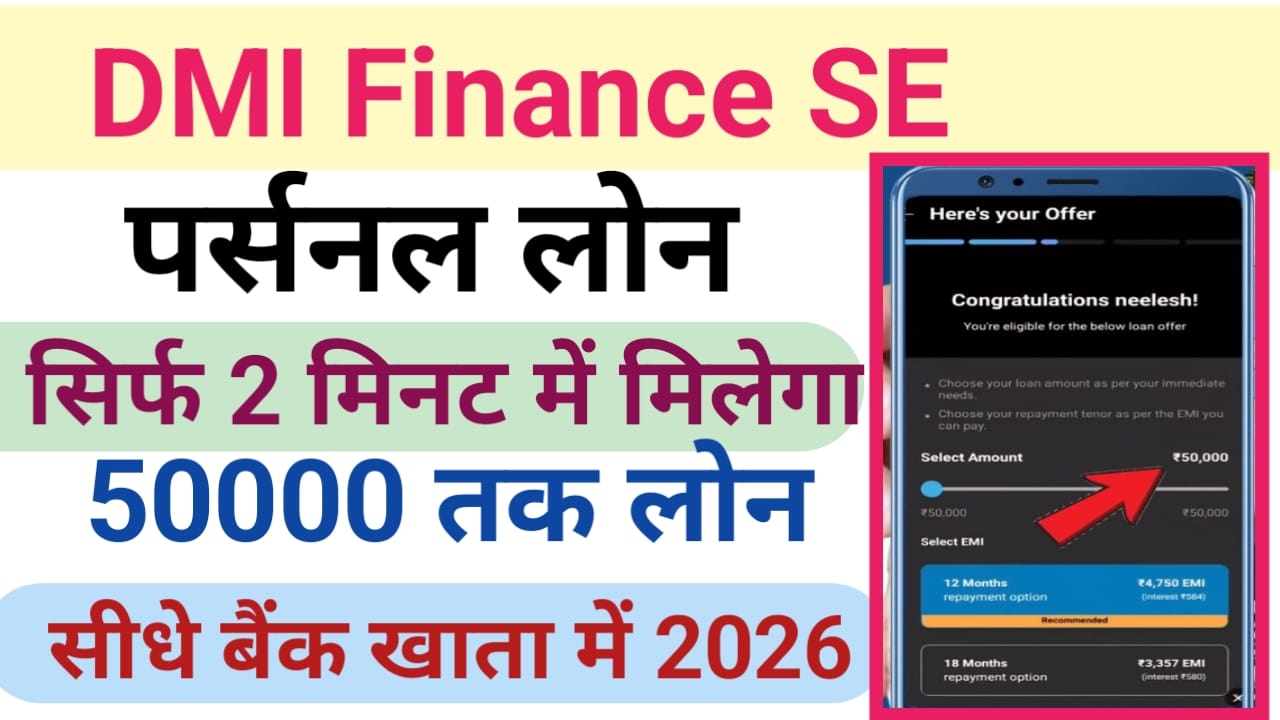

DMI Finance Personal Loan Online Apply Online Apply

Hello friends, I welcome you all to today’s article. Friends, we will inform you about how to get a personal loan from DMI Finance. You will be happy to know that you can now take the help of DMI Finance to get a loan and can apply for it sitting at home. This takes minimum time and you also get a 100% secured loan. DMI Finance is an

Indian non-banking financial company that provides personal loan, business loan and housing financial services. It is digitally enabled and offers quick and simple payment processing. In today’s article, we will explain its complete details so that you can easily take out a loan from DMI Finance. To do this, you will need to read this article carefully until the end.

Eligibility for Loan from DMI Finance

- The age of the applicant taking loan from DMI Finance should be between 21 years to 60 years.

- There should be a stable and regular source of income. This could be either a job or a business.

- The applicant’s credit score must be 650 or higher. Debit card or internet banking will be required for loan approval.

- Any document that will be asked by DMI Finance and your Aadhar card must be linked to your mobile number.

How to get a personal loan from DMI Finance?

If you want to apply online for a personal loan from DMI Finance, then for this you will have to follow all the procedures given below step by step, which are as follows –

- To avail a personal loan from DMI Finance, first of all you will have to install the DMI Finance Application from the Play Store of your mobile phone.

- After installation, you will have to register by entering your mobile number and necessary details.

- After registration, you will have to fill in your personal information like your name, address, date of birth etc.

- Now you will have to complete the KYC process by uploading documents like Aadhar card and PAN card.

- After that you will have to qualify the loan and select the required loan amount.

- After entering all the details, you will have to submit your loan application.

- Now DMI Finance will check your credit score and documents and after that you will get the information about approval or rejection of the loan.

- Once the loan is approved, the loan amount will be transferred to your bank account.

- Along with the loan amount, you will be given information about the repayment plan and interest rate.

In this way, you can easily apply online for a personal loan from DMI Finance by following all the steps mentioned above.

DMI Finance Personal Loan Interest Rate

- The interest rate on dummy finance depends on your credit score, the loan amount, and the term. It typically ranges from 12% to 24% p.a.

- Prepayment of the loan may attract prepayment charges which can range from 2% to 5% of the remaining loan amount.

- If your cheque bounces, a penalty of Rs 500 to Rs 750 may be imposed.

- If you don’t pay your installment on time, you may incur a late payment fee. This fee typically ranges from 500 to 1000 rupees.

- A processing fee of 2% to 4% of the loan amount may be charged. This fee is deducted at the time of loan approval.

- Sometimes some small charges like stamp duty or extortion fee may also be levied.

conclusion –

Friends, in today’s article, you will be informed about how to take a personal loan from DMI Finance. We will tell you its complete online application process in detail so that you can easily take a personal loan from DMI Finance sitting at home and can also get its benefits. Friends, if you all liked today’s article, then definitely share this article.How to take loan from DMI FinanceHow to take loan from DMI