How to take loan from SBI Credit card

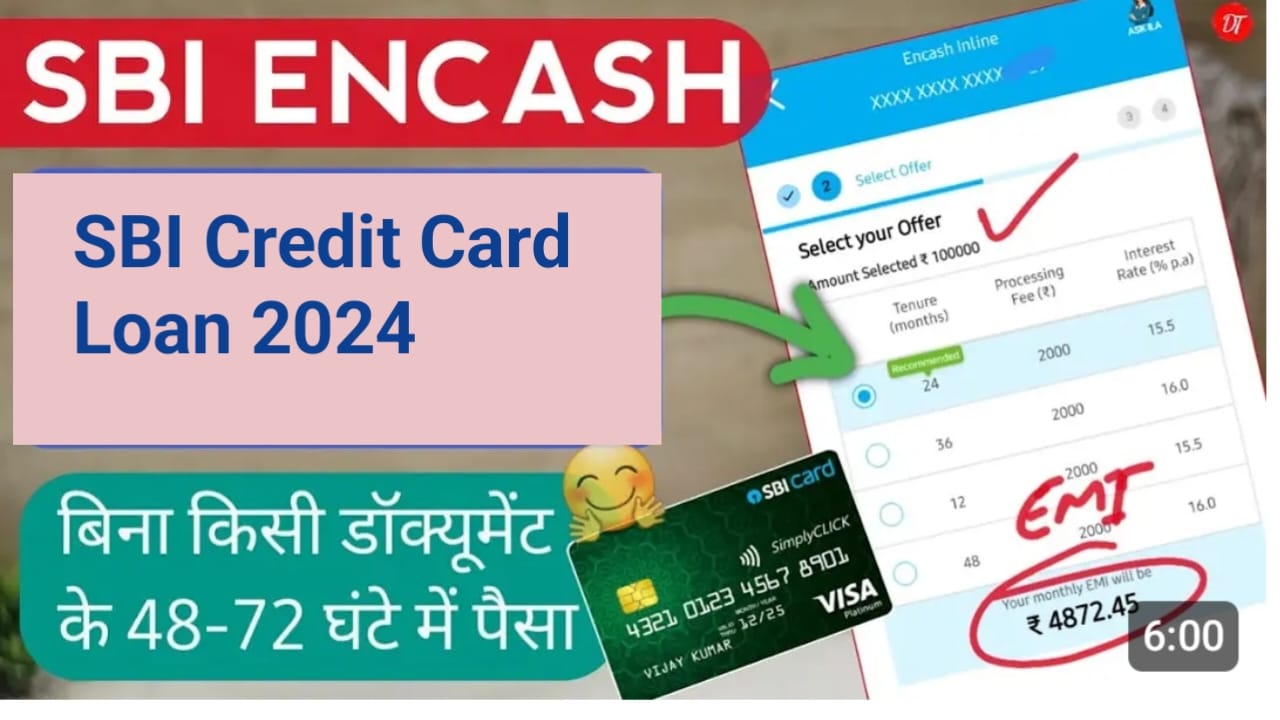

Hello friends, I welcome you all. Friends, in today’s article you will know how to take loan from SBI credit card. Friends, SBI credit card is a pre-approved loan or money on-demand facility which is specially offered to SBI credit card holders. This interest rate starts at 15% per annum. The loan repayment period is up to 4 years, this loan also provides zero documentation and foreclosure facility. The loan amount is transferred to the applicant’s bank account within 48 hours of the loan application.

The loan amount is also transferred through payable-at-per cheque. It takes 3 working days for metro cities and 5 working days for non-metro cities. Friends, if you want to take loan from SBI Credit card then in today’s article we will tell you all the information in full detail so that you can easily take loan from SBI credit card. For this reason, you will have to pay attention to this article till the end.

eligible to take esbiaai credit card loan

1. Only Prahamik card holders can avail loan from SBI Credit card for free and free transfer.

2. Only selected existing customers holding SBI credit card can avail the benefit of incash/incash inline facility of the bank.

How to apply for loan from SBI Credit card?

Friends, if you want to take loan from SBI credit card then you will have to follow all the steps mentioned below –

net/mobile banking

Having an existing SBI Credit card, you can login to your net banking account from the bank’s website or you can use the SBI Card app. By following all the steps mentioned below, you can apply for the loan.

1. Customers eligible for incash or incash inline will see the incash/incash inline link under the benefits section on left hand navigation.

2. By visiting the incash/incash online link, you can check the interest rate and loan amount of SBI credit card loan. You can enter the desired amount to confirm your banking details for credit card loan facility.

Customers can also login to the chaitbot ILA facility, ask questions for online banking and follow the steps mentioned in the chaitbot to apply for SBI credit card loan.

phone banking

To avail the existing SBI credit card incash/incash inline facility and to check your eligibility, you can call the SBI card helpline numbers given below.

1. 3902 02 02 (put local STD code before the number)

2. 1860 180 1290

Customers can also send SMS ‘incash’ to 56767 to confirm their SBI credit card loan eligibility.

You can avail loan against credit card facility using existing SBI card through payable-at-par cheque. Bank SBI allows transfer of credit card loan amount through due-at-par check within 3 working days and 5 working days.

What is SBI Credi card loan interest rate?

1. 18.50% to 20.50% party war for 700 or less bureau scores

2. Interest rate 15%-15.50% party year for bureau score more than 780

3. 15.50%-16.50% party year for bureaus between 700 to 780

Generally, credit card loan interest rates are higher as compared to normal personal loan interest rates. SBI Credit card holders should compare the SBI personal loan interest rates before taking a credit card loan.

Conclusion-

Friends, in today’s article you have been given complete information on how to take loan from SBI credit card. In today’s article, you have been given complete information about how you can easily take loan from SBI credit card and get benefits from it. can do Friends, if you like this information then please share this article.