SBI Bank Se Personal Loan Kaise Le |

Hello friends, I welcome all of you. In today’s article, we will give information about how to take a personal loan from SBI Bank. Friends, India’s largest bank, State Bank of India, is providing personal loan facility to its customers in easy terms, from where you can fulfill your needs by taking a loan. Friends, in today’s time, every person has to face problems related to money at some point in life,

due to which they take a loan from such a place, repaying which becomes a big problem for them. But now you do not need to take a loan from anywhere to fulfill your need, because India’s largest bank is giving you personal loan with low interest rate. Friends, if you want to take a personal loan from SBI Bank, then in today’s article, we will tell you its complete information in detail, for this you have to read this article carefully till the end.

What is the eligibility to take a personal loan from SBI Bank?

The applicant must be a citizen of India to take a personal loan from SBI Bank.

The monthly income of the applicant should be more than Rs 15000 to take a personal loan from SBI Bank.

The age of the applicant taking the loan should be between 21 years to 58 years.

The applicant taking the loan should be employed in the Central Government, State Government, Public Sector Undertaking and MNC Company.

The applicant taking a loan from SBI Bank should be either salaried or in business.

The work experience of the applicant should be at least more than one year.

The credit score of the applicant taking the loan should be more than 730.

Documents to take a personal loan from SBI Bank

Identity proof – Aadhar card, ration card, PAN card, voter ID and passport.

Income proof – salary slip of last 3 months, bank statement of last 6 months.

Address proof – driving license, voter card, telephone and electricity bill.

Active mobile number.

Latest photo of the applicant

How to take personal loan from SBI Bank?

Friends, if you want to apply online to take a loan from SBI Bank, then applying online is very easy. To take a personal loan from SBI Bank, you can apply online through SBI’s official website or SBI YONO application. To take a loan from SBI Bank, you have to follow all the steps given below – To take a personal loan from SBI Bank, first of all you have to go to the home page of SBI’s official website. After coming to the home page,

you have to click on the Personal Loan option in the loan section. After clicking, a new page will open in front of you in which you will be told about different types of SBI Personal Loan. Now after reading the information about SBI Personal Loan, you have to click on the option of Apply Now.

After clicking, a new page will open in front of you in which all the information asked by SBI will have to be entered. After that, loan will be offered by State Bank on your basis. To take this loan offer, you have to click on the option of Continue. After that, the SBI loan application form will open in front of you, in which you will have to enter all the information asked by the State Bank.

After that, the application form will have to be submitted by uploading the required documents.

After that, your loan application form will be verified by the State Bank, after which your loan will be approved by SBI.

Benefits of taking a personal loan from SBI Bank

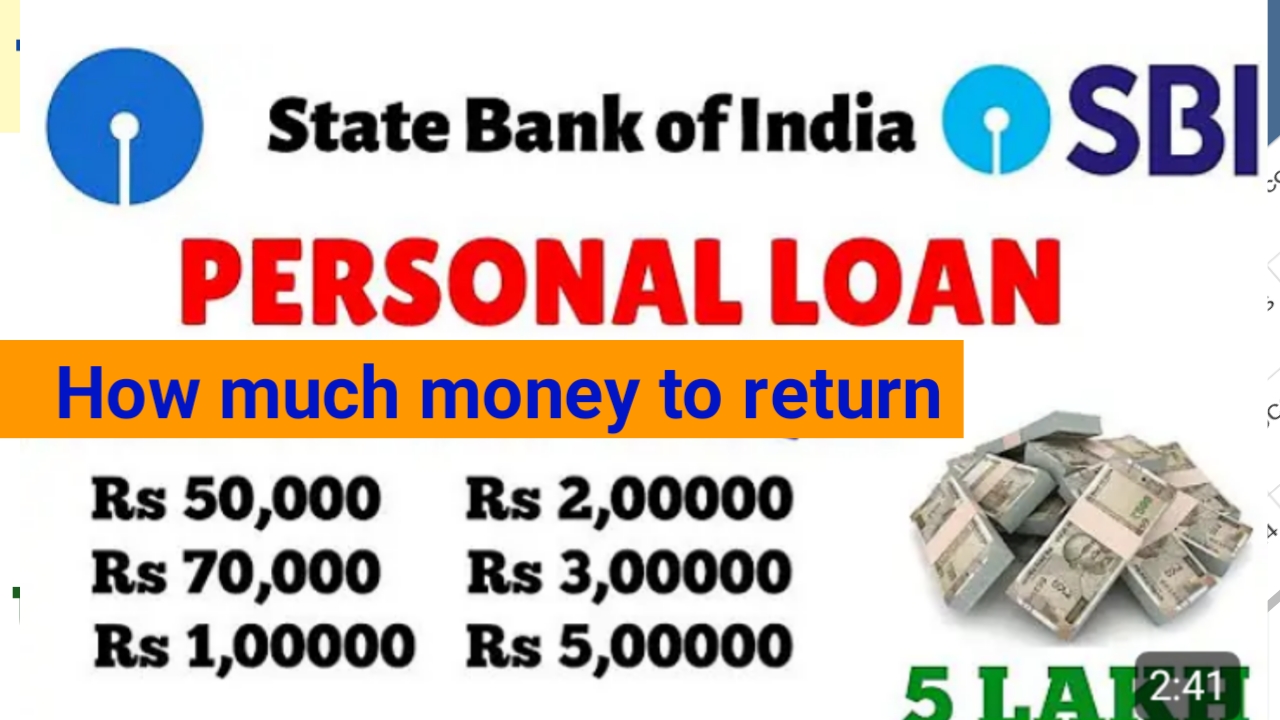

State Bank of India provides personal loan of 50000 to 20 lakhs to its customers.

You can repay the loan for a period of 6 years.

SBI Bank charges very low processing fee on taking a personal loan.

You can use personal loan for any of your personal work.

The interest rate of SBI loan starts from 10.49%.

Conclusion –

Friends, in today’s article, we have given information to all of you about how to take personal loan from SBI Bank, its complete information has been given in full detail in today’s article so that you can easily take personal loan from SBI Bank and get its benefits. Friends, if you like this information then please share it.